WaterCredit Initiative®

Small loans, big impact: the power of WaterCredit

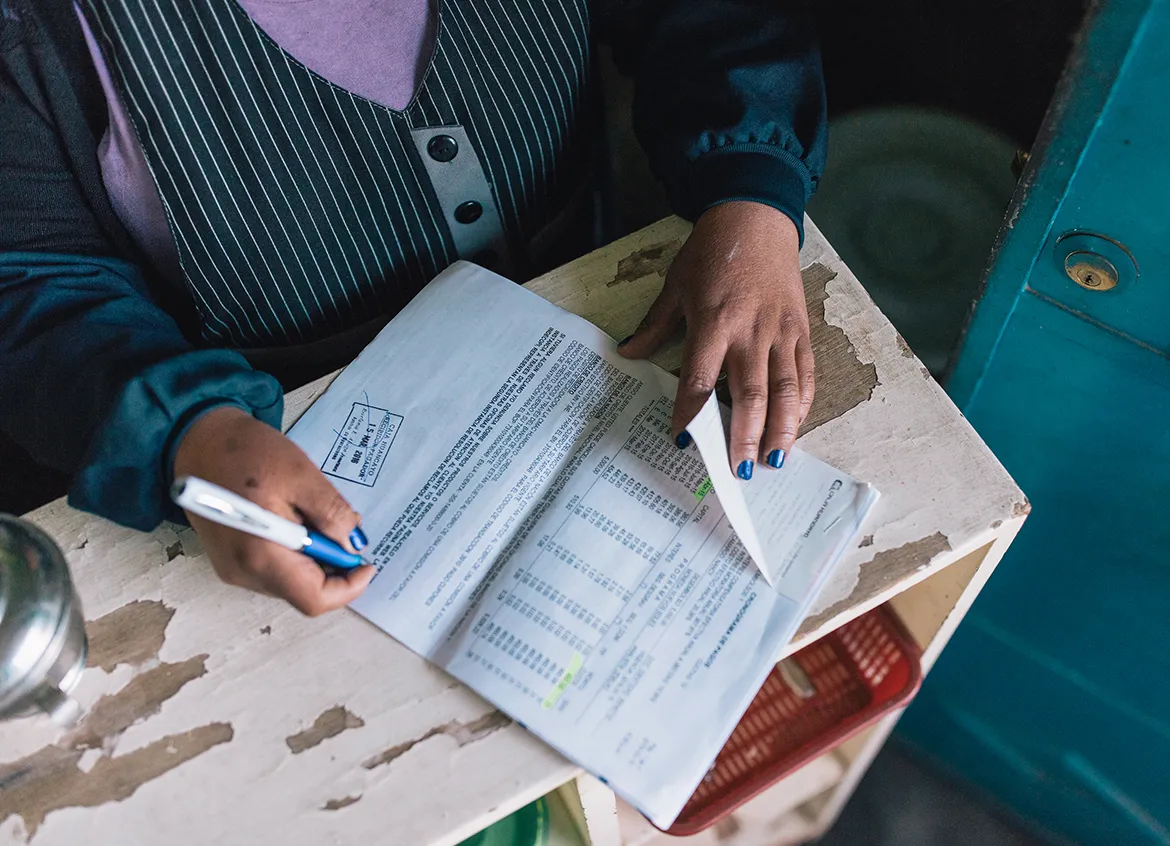

One of the major barriers to safe water and sanitation is affordable financing. We created the WaterCredit Initiative® loan program to address this barrier head-on. WaterCredit helps bring small loans to those who need access to affordable financing and expert resources to make household water and toilet solutions a reality.

With millions affected across the world, there is not a one-size-fits-all solution to the global water crisis. Our approach is market-driven and people-driven. We have changed more than 79 million lives through our WaterCredit Initiative and with your support, we can help empower even more people with safe water and sanitation solutions that last.

People already pay for water, but it's costly

People in need already pay high prices for water, in both time and money. The truth is that many of these families can get a water or sanitation solution in their home for a fraction of their annual water costs. All they need is access to affordable financing to make this a reality. We believed that if given a choice and an opportunity to pay for water and sanitation improvements over a reasonable period of time, millions of people living in poverty would finance long-term solutions versus struggle day-to-day to find that next liter of water.

Many financial institutions in developing countries aren't offering loans for water and sanitation to people in need. We bring resources and consulting expertise to these organizations, equipping them to successfully add water and sanitation loans to their portfolios of offerings. Through WaterCredit, we are making water and sanitation loans accessible to those who need them the most. And the results are astounding.

How it works

WaterCredit is a powerful solution and the first to put microfinance tools to work in the water and sanitation sector.

Here’s how it works:

- We identify a region where people need access to water and sanitation and that is ready for a microfinance solution.

- We partner with carefully selected institutions to provide affordable financing for water and sanitation to families in need.

- These partners establish water and sanitation loans in their portfolio of offerings. We support them by providing technical assistance, connections and resources to get them started.

- People in need use these small, affordable loans to put a tap or toilet in their homes and access local resources to do the work.

- Every repaid loan can be lent to another family in need of safe water or sanitation.

A proven, powerful solution

After more than 15 years in action, WaterCredit is a proven, powerful solution. More than 79 million people on 4 continents now have access to safe water or sanitation.

Together with our 184 partners around the world, we've catalyzed $6.8 billion in capital to support small loans that bring access to safe water and sanitation to millions of people living in poverty.

Our solution is in high demand, sustainable, and reaching people in need. 90% of borrowers are women – those most impacted by the water crisis – and the majority of households borrowing the loans live on less than $6.85 a day.

A long-term solution for families in need

It’s smart, simple and sustainable. More importantly, it helps the people we empower solve their immediate need and continues to enrich their lives long after the original loan has been repaid. This solution works because it recognizes people as consumers with autonomy and empowers people to define their own futures.

Through WaterCredit, women who previously spent hours each day collecting safe water have time to pursue education, work and keep their families safe and healthy. That’s the power of water.

A smart investment

Our smart solutions are efficient, reaching more people at a lower cost. With Water.org, every dollar donated will have the greatest impact.

The truth is, WaterCredit is a catalyst. With support from Water.org, our 184 partners can attract capital, giving out more loans to bring access to safe water and sanitation to millions.

Loan repayment rates are 98% globally, and every repaid loan means another family can get safe water at home. It’s a cycle that continues to reach more people, creating new opportunities for families around the world.

Reaching more people, faster

Current efforts to solve the global water crisis are not reaching people fast enough, so we created WaterCredit to help close the gap. WaterCredit is scaling and the impact is accelerating. A few years ago we were able to reach one million people in a year. Now we can reach this many people in a matter of months.

We’ve empowered more than 79 million people with access to safe water or sanitation through small, affordable loans. We reached more than 10.4 million people in 2024 alone.

Partners make our work possible

We work with and through local partners to make WaterCredit self-sustaining, helping set-up a system that lasts long after our involvement ends. Once organizations start lending for water and sanitation, they are set up to continue lending. It’s a cycle that continues to reach more people.

Become a lending partner

We work with local financial institutions and other partners who understand the needs of their communities and are invested in their success. We provide technical assistance, connections, and small grants, as needed, so they can provide small loans to people in need of water and sanitation at home.

Help us change more lives through WaterCredit.

Donate